Talk with one of our education savings specialists.Įffective immediately, College Savings Iowa education savings specialists will be available to provide assistance on business days from 8 a.m. The combination of financial aid and grants, student loans, and scholarships can bring down the sticker price of college for your student.

College savings planner calculator full#

It is also good to remember that very few parents actually pay full price for college. Just remember that saving early and often can help. Get your personalized projection External website opens in a new windowĪs scary as the projections might seem, it is still possible for you to help your child get a great education.

If you already have an idea where your student is headed, you can use the college savings calculator to get a personalized projection for a particular college or state. If you want to get an idea of what the future cost of college might be based on your time frame, try our college cost calculator.Ĭalculate the future cost of college External website opens in a new window How much do I need to save? How much could college end up costing me? At 18 years, the estimated costs are $62,653 for public college and $142,346 for private college.

At 15 years, the estimated costs are $52,604 for public college and $119,516 for private college. At 10 years, the estimated costs are $39,309 for public college and $89,310 for private college. At 5 years, the estimated costs are $29,374 for public college and $66,737 for private college. In 2019–2020 the cost for 1 year was $21,950 for public college and $49,870 for private college. Putnam Investment Management, investment manager.This chart shows that in 18 years the average cost for 1 year of college could increase by more than $40,000 for public college and by more than $92,000 for private college. Putnam Retail Management, principal underwriter and distributor. Please read the offering statement carefully before investing. For an offering statement containing this and other information for Putnam 529 for America, contact your financial representative or call Putnam at 1-877-PUTNAM529. Investors should carefully consider the investment objectives, risks, charges, and expenses of any fund before investing. Opinions or recommendations on any linked websites are those of independent providers and do not imply a recommendation from Putnam Investments, which is not responsible for inaccuracies or errors. Carefully review the site's terms of service and privacy rules as they apply to you. Putnam Investments is not responsible for the content or services offered on linked websites. Consult a tax advisor.īy clicking on links to third-party sites, or using social media sharing tools, you will leave this Putnam Retail Management hosted property. If you withdraw money for something other than qualified higher education expenses, you will owe federal income tax and may face a 10% federal tax penalty on earnings.

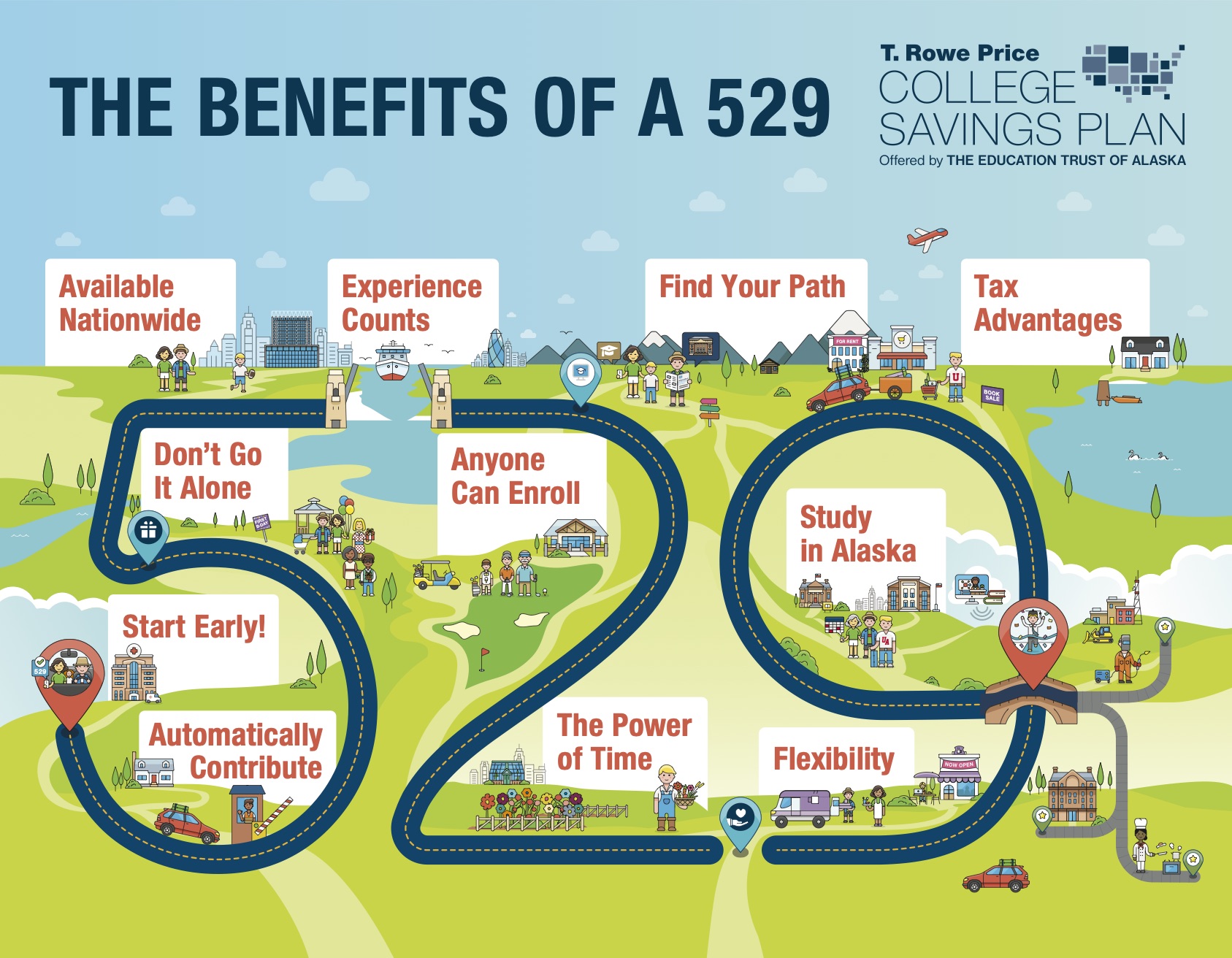

Before investing, consider whether your state's plan or that of your beneficiary offers state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that may not be available through Putnam 529 for America. Anyone may invest in the plan and use the proceeds to attend school in any state. Putnam 529 for America is sponsored by the State of Nevada, acting through the Board of Trustees of the College Savings Plans of Nevada, and administered by the State Treasurer's Office.

0 kommentar(er)

0 kommentar(er)